Over the past few years, many apps that focus on money management and lending loans started popping up on the market, and one name that stood out is Moneylion. With over three million users, Moneylion enables consumers to manage their own finances by adding their bank accounts, applying for loans, and monitoring their credit scores. While Moneylion is a powerful finance and banking app packed with useful features that everyone could take advantage of, looking for apps like Moneylion would still be an excellent investment for both your time and money. Furthermore, some apps specialize in either giving out loans or providing users a comprehensive view of their personal finances, whereas Moneylion is more of a general finance and lending app. There are also some features that certain finance and mobile banking apps have that Moneylion does not have, such as saving initiatives or connecting with money lenders. With that being said, here are some of the best Moneylion alternatives in the market that you can try.

Apps Similar to Moneylion

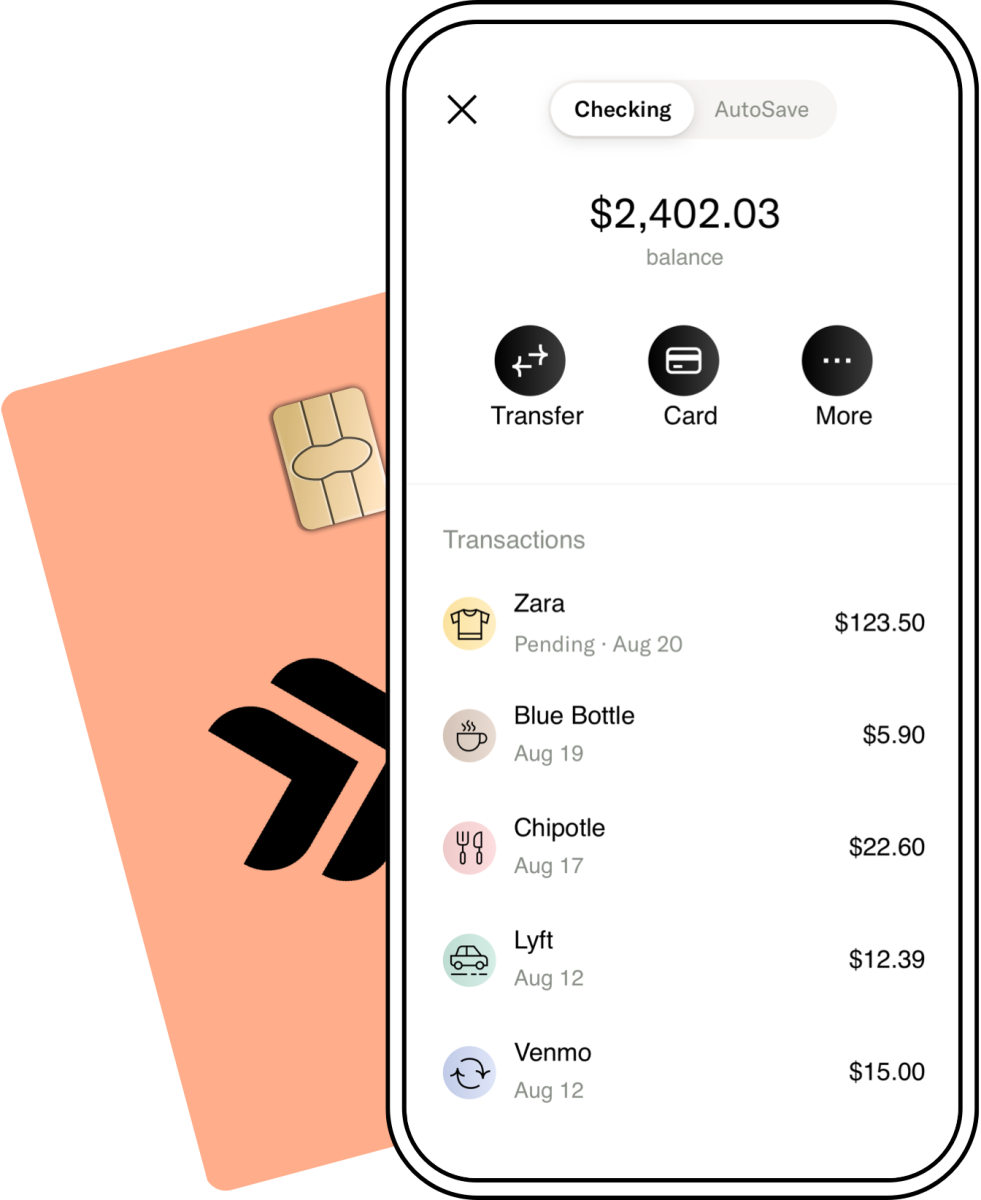

1. Chime

Chime is a personal finance app that provides consumers a comprehensive view of their finances in just a few taps, just like Moneylion. This app also allows users to access their money immediately compared to traditional banks, where they would need to wait for around two days before you could use the money. Aside from these cool perks, Chime also allows users to access their accounts through 38,000 ATMs without worrying about any fees. Besides that, Chime also gives real-time transaction notifications to users, allows users to block cards in the app, enables easy transactions through Google and Apple Pay, provides instant money transfer with Chime partners, sends balance alerts daily and instantly, and more. You can use Chime without the fear of paying hidden fees or monthly charges, overdraft fees, and extra fees for foreign exchange transactions. Chime also offers no minimum balance requirements.

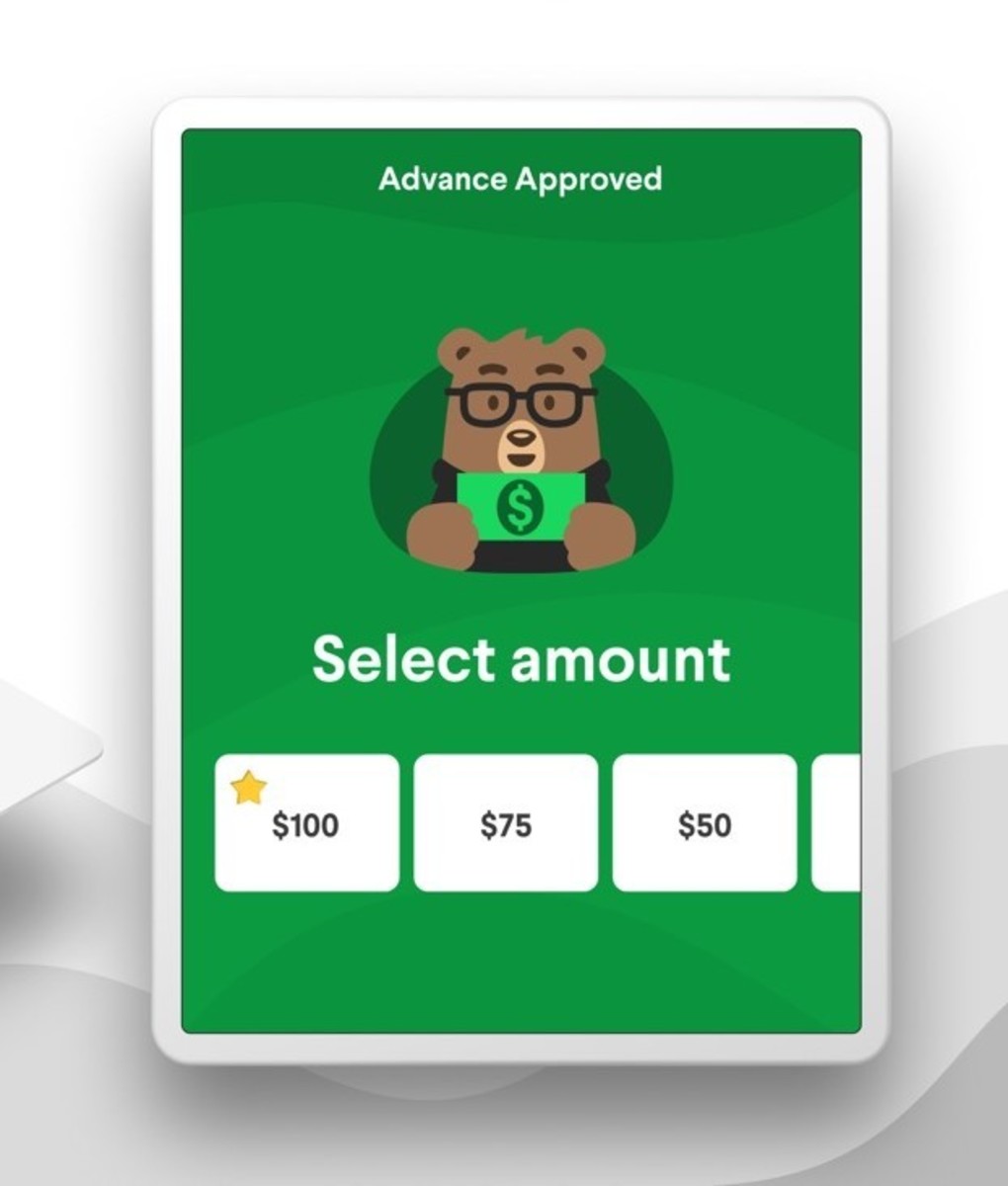

2. Dave

This app does not only have a unique name, but it also gives employees up to $100 in advance from their upcoming paycheck without interest and allows users to save up to $500 per year using this app. What makes Dave different from Moneylion is its budgeting tools and features. Through the Dave app, users can track their expenses by planning their budget for needs like food, rent, and utilities. Also, Dave gives instant alerts once users exceed their planned budget. While Dave charges users a dollar per month to get access to the app’s powerful personal finance tracking tools and features, it’s still worth checking out if you want to avoid hefty interest rates from payday loans and overdraft fees.

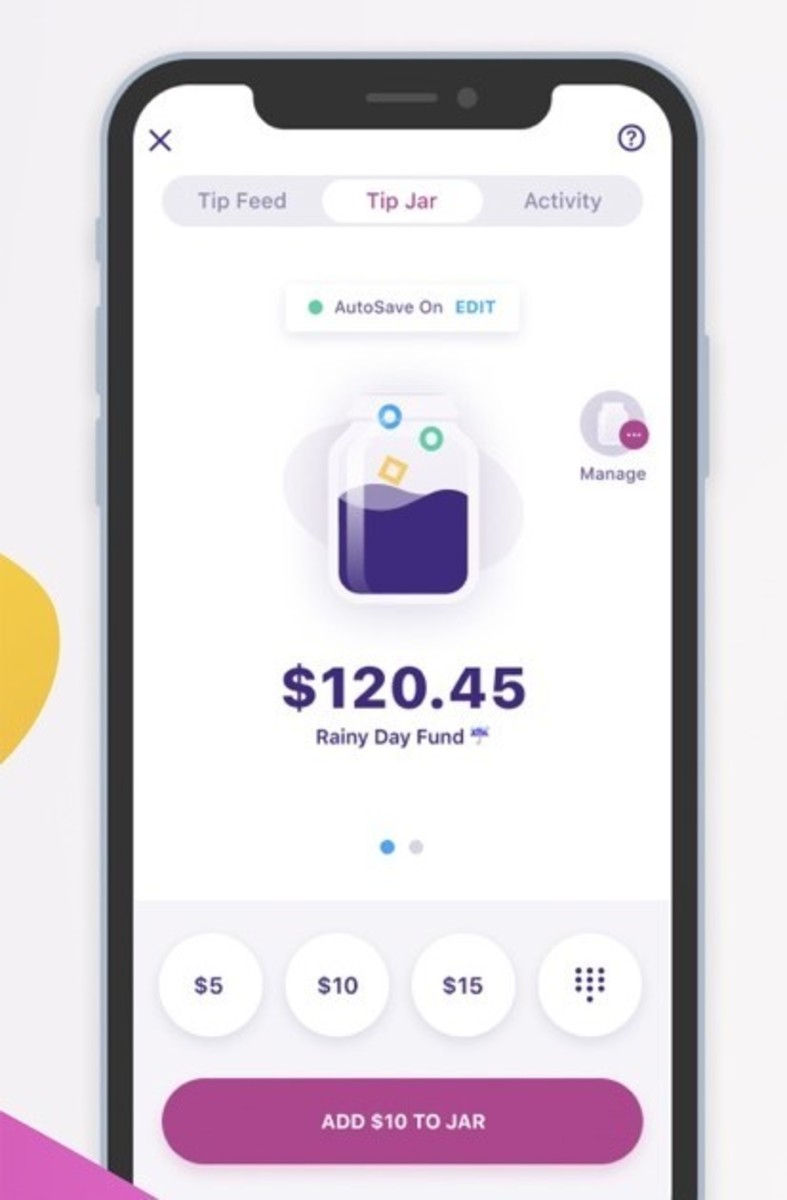

3. Earnin

Earnin is another powerful Moneylion alternative that offers budgeting tools, getting money instantly, providing options on medical bills, earning cashback with every purchase, and more with just one app. Users can connect their debit card on the EarnIn app, and they could get their money swiftly without any additional charges. Aside from this, Earnin also features a Tip Jar, which encourages users to save little-by-little by tipping themselves. This feature allows you to tip yourself when you achieve a goal, such as eating healthy or going to the gym, or when you simply want to. Another cool feature that Earnin has is the Financial Calendar, which helps users keep track of their recurring monthly expenses such as bills and make a budget based on these expenses.

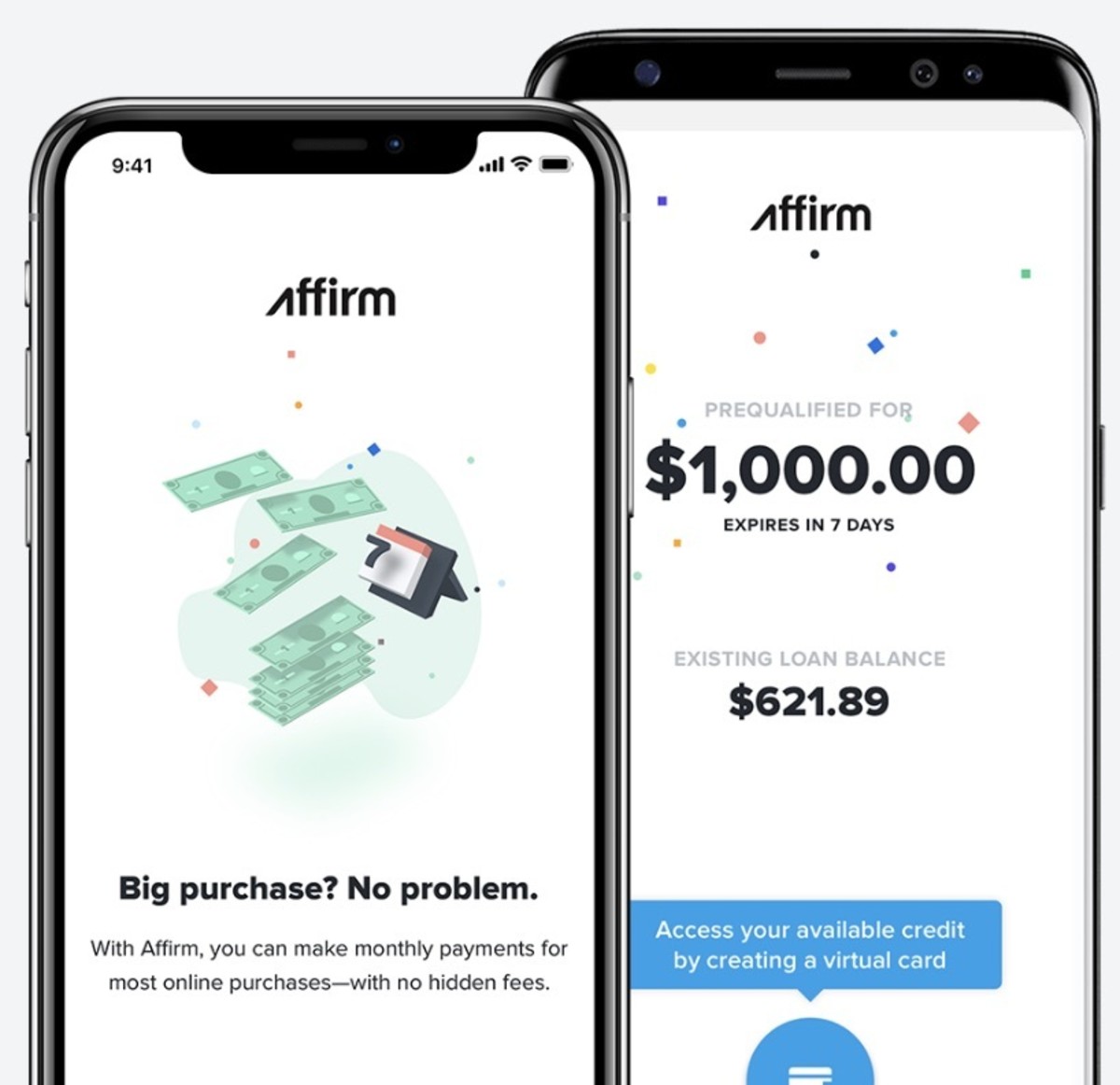

4. Affirm

Affirm is not your ordinary finance app. This app provides a great and extraordinary way of paying for the stuff you want without spending your entire salary or savings. With Affirm, users also do not need to worry about late fees, penalties, or other hidden charges when purchasing a product. The app is also friendly for first-time users. To use this app, you only need to go to your chosen store or retailer, add your preferred item to the cart, and then choose the payment plan that would best suit your budget. Affirm allows users to split payments into monthly installments, and you can complete your payment online or pay at a physical store through Google or Apple Pay.

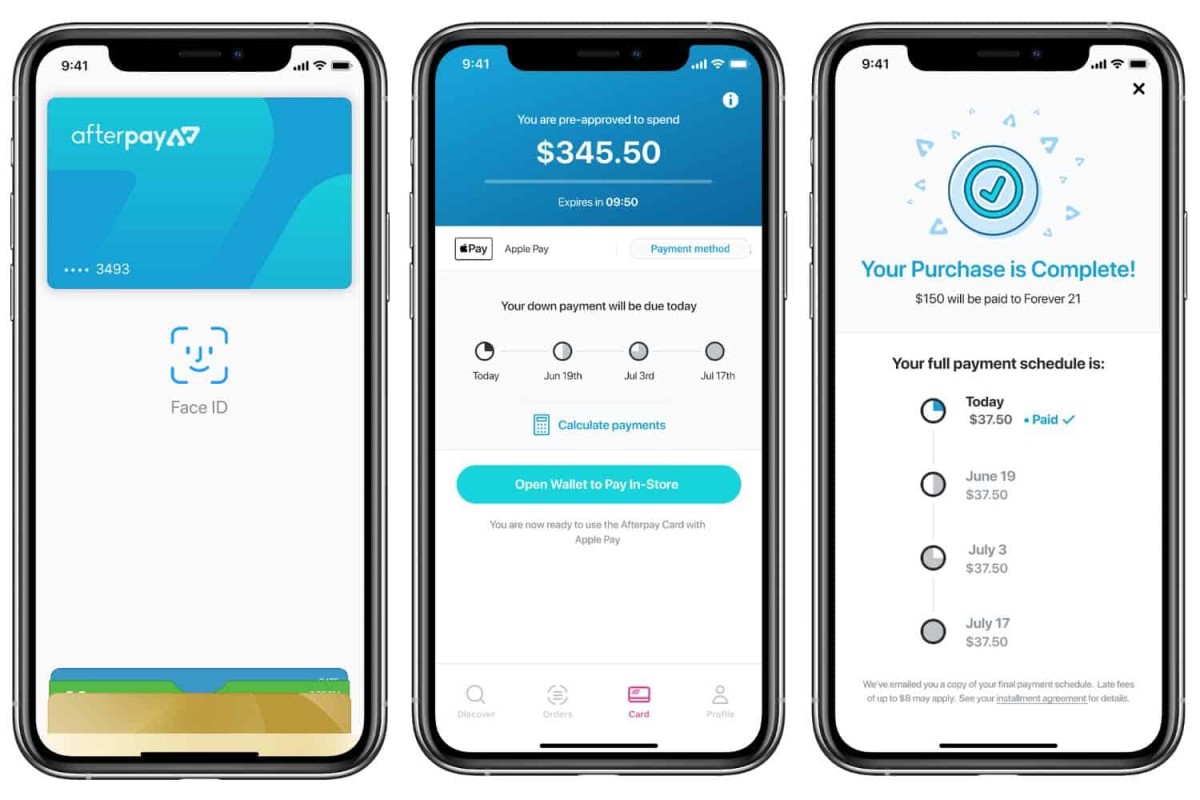

5. AfterPay

The name of the app says it all. AfterPay enables users to purchase a product and then split the payment into four equal installments for two weeks. You can also use the app to make purchases without the fear of interest rates showing up on your bill. You can also pay directly through the AfterPay app, or if you wish to purchase through a physical store, you may scan the barcode and pay the needed amount. What’s more is that once the first installment has been paid, the item you purchased will be shipped without having to pay for the next installment.

6. Empower

This app’s name is exactly what it does to employees struggling with budgeting their expenses and getting their paycheck advance when they need it. Empower allows employees to get a paycheck advance for up to $250 on their bank account, although eligibility requirements may apply for this advance. Furthermore, Empower helps users track their spending and even features an automatic savings plan for those who are having difficulties saving and budgeting their paycheck.

7. PayActiv

PayActiv is an app that offers more than just alternatives to payday loans and bank loans. It is also a financial counseling app that provides assistance to employees and other people who struggle with planning their finances. The app also provides prescription discounts and allows users to pay their bills from there. Additionally, PayActiv also has a debit card attached to every account so that employees could access their money without having to worry about fraud. However, if employees want to access their paycheck early, they would need to pay a flat fee of $5, although this charge could be subsidized by employers.

8. PockBox

PockBox is less of a finance tracking and mobile banking app and more of a marketplace where users could choose and connect with short-term money lenders who could loan up to $2,500 instantly. Getting a loan is also easy in PockBox compared to other apps or payday lenders. All you need is to fill up a few forms, and you will be connected with a lender who could provide you with a loan on the next business day. Nevertheless, the charges and interest loans you would incur when you get a loan would depend on the lender you choose, although PockBox is still a greater alternative for loans than payday lenders.

9. Wealthfront Cash Account

Wealthfront is an app that offers banking products to employees and other customers, such as a cash account. In addition, Wealthfront is also considered as one of the best robo-advisors when it comes to finances. The greatest thing about Wealthfront is that you can get your money for up to two days earlier than normal with its cash account. While this does not seem helpful initially, receiving your paycheck on time helps in budgeting your expenses and ensures that your bills are paid promptly.

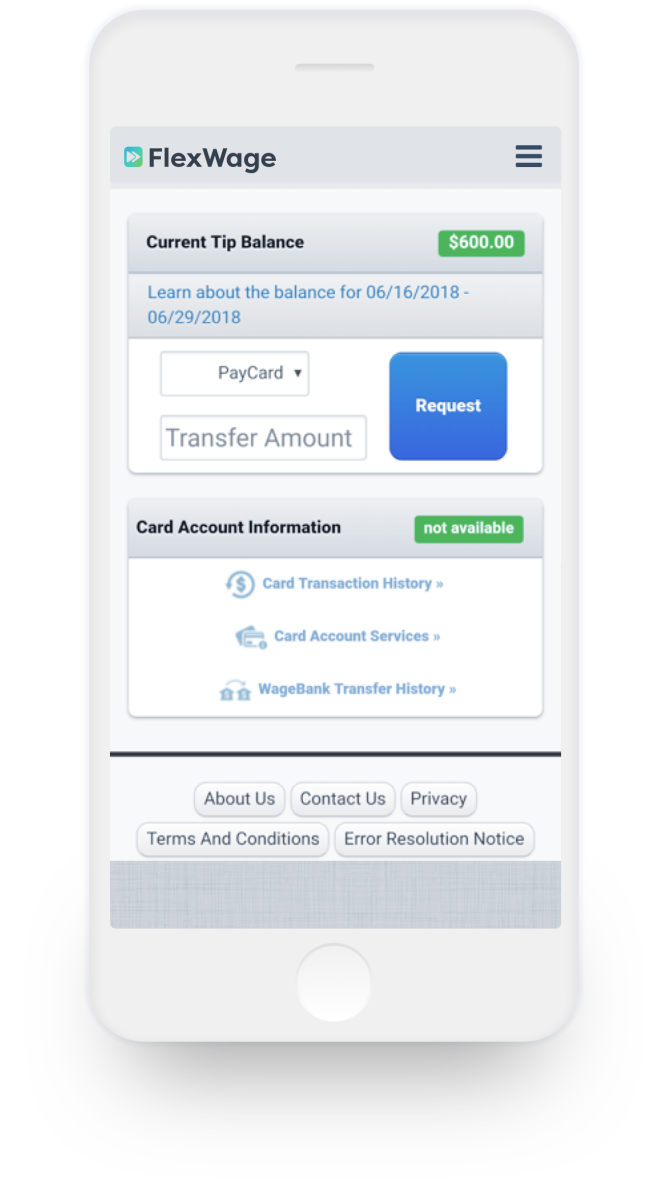

10. FlexWage

FlexWage is an app that provides comfort and relief not just for employees but also for employers when it comes to the paycheck and the hassles of administering them. FlexWage enables employees to access their paychecks when they need it. It also provides reloadable payroll debit cards for employees who receive paper checks yet are unbanked and could not receive direct deposit. However, there are fees when transferring the paycheck and using the debit card. Nevertheless, these charges are usually lower compared to getting a payday loan.

Bottom Line

Managing personal finances, keeping track of spending, and getting a loan when you need it are just some of the difficult things that an employee or anyone who lives from paycheck to paycheck would encounter. While the principle of spending only within your means is the cornerstone of improving your financial health, putting this into work might not always be easier than expected. Nevertheless, these apps could not just provide alternatives for Moneylion, but also help people struggling with their finances and monitoring their expenses. You can use these apps to get financial help through loans and even grow your money through money-saving features. Who knew that saving money, applying for a loan, and keeping track of expenses would now be easier with just a few taps on your screen? It’s time to explore these apps like Moneylion and keep the ones that help you achieve your financial goals.

Comments

BRENDA ARLEDGE from Washington Court House on December 12, 2020: This is a very detailed article packed with useful information. I have used affirm to pay for a ourchase and it works really well. You can even pay off ahead of time and save all that interest. As for saving money with financial stuff…I am still a bit old school. I am not sure I trust an online source with my little bit of money. I still use a bank that I can walk into if I want. Take care.